Hidden Risks When You Buy Car Insurance in Vermont

Hidden Risks When You Buy Car Insurance in Vermont

When shopping for car insurance, you should beware of a money trap commonly used by insurance agents to dupe you into paying for coverage that you don’t need while discouraging you from receiving coverage that could be critically important to you if you get injured in an accident.

Unscrupulous insurance salespeople convince you to buy way more property damage coverage than you could ever possibly need, while not making sure you get enough coverage if you’re hit by an uninsured or underinsured driver. This tactic is commonly used to fleece elderly people, who tend to fret about damage to the things they own and often are on a tight household budget.

Is Your Uninsured/Underinsured Coverage High Enough?

Some drivers carry only minimal liability insurance, and some people actually break the law and carry no insurance at all! If you are badly hurt by one of these minimally insured, or totally uninsured, drivers, you’re going to have to rely on your own coverage to step up and pay for the difference between the other driver’s policy limit and the medical bills you’ll owe for your treatment.

In other words, uninsured/underinsured motorist coverage is for you, not anyone else.

But if you have low underinsured (or uninsured) motorist coverage, you are in big trouble. In a serious case, you will not have enough money to pay your health providers for your treatment, meaning you could be left owing them money. There will certainly be nothing left over to compensate you for your pain, your disfigurement, your permanent impairment, your lost earnings, your future medical care and the harms that flow to your loved ones because of all of that.

An Auto Accident in Williston, VT Reveals All

I recently made a house call at the request of an elderly couple who had suffered serious personal injuries, including broken bones, in a car crash. Worried that the person who hit them might not have enough insurance—the minimum limit for liability coverage in Vermont is only $50,000—I checked their own insurance policy’s declarations page to see if they had enough underinsured motorist coverage.

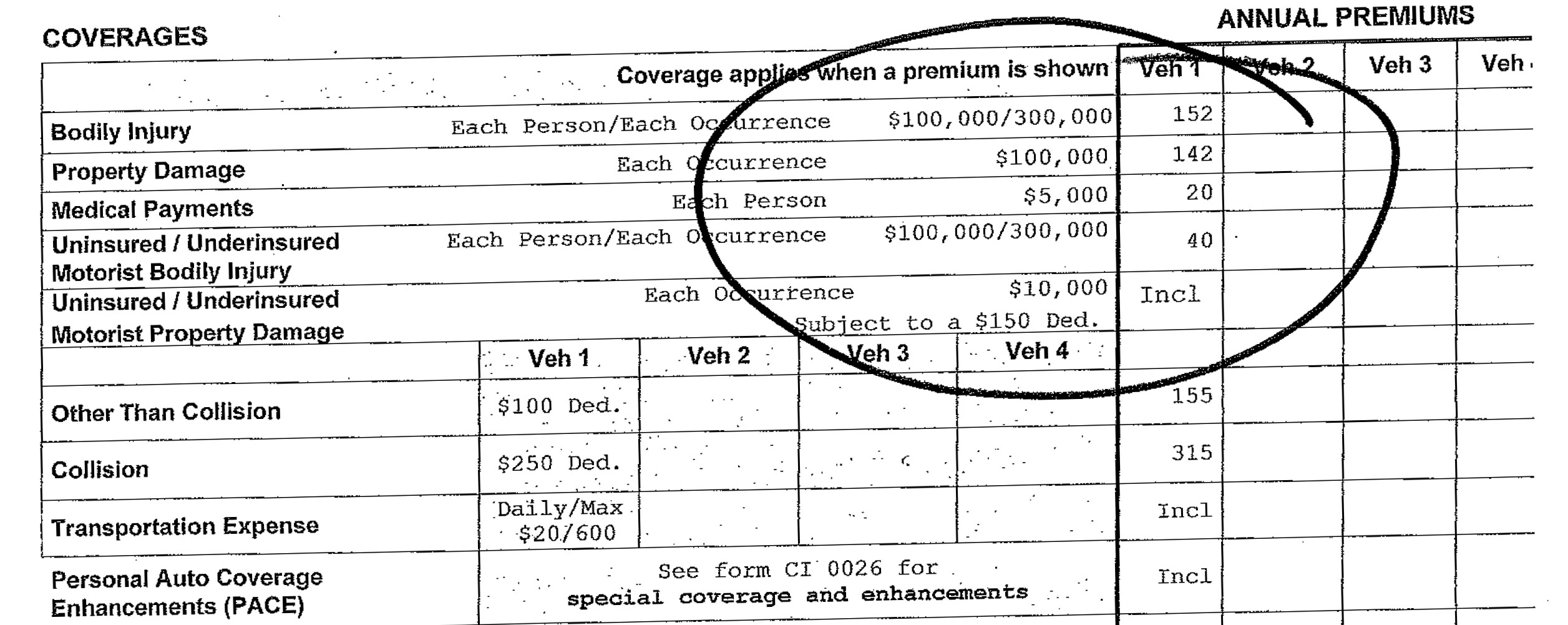

What I discovered was shocking: They had only $100,000 in underinsured motorist coverage and an extravagant $100,000 in property damage coverage—for a 2009 Mercury Milan!

No, this retired elderly couple, one of whom suffers from severe dementia and is being cared for by her husband in their home, do not transport Faberge eggs in their car when they go out once a week for groceries. There simply is no need—whatsoever—for them to be paying for such an extravagant amount of property damage coverage.

Worse, this same policy only gives them $100,000 in underinsured motorist coverage, which in this day and age could be eaten up very quickly in medical expenses in a serious injury case.

The kicker: their annual premium for the property damage coverage was $142 while the premium for their uninsured/underinsured motorist coverage was $40.

In other words, they wasted at least $100 on coverage they’ll never need while foregoing the chance to spend that same money on higher liability and uninsured/underinsured motorist coverage to protect themselves, and which they now wish they’d been advised to purchase.

Insurance Agent Scams

The real travesty? The insurance agent, who makes a commission by upselling this property damage coverage, knows this couple’s property damage could never reach the policy limits, and the agency also knows if they are badly hurt, they will absolutely need the uninsured/underinsured motorist coverage.

The insurance company also knows that with medical costs the way they are, their precious bottom line would be at risk in the event of a catastrophic injury to either or both of these elderly people.

In other words, they avoid selling high uninsured/underinsured motorist coverage because it could cost them lots money if the policy holders are hurt, while steering people toward unduly high property damage coverage that they will pay for handsomely but never fully use.

They were, in fact, talked into this by their own insurance agency right here in Vermont. This is not the first time I’ve seen this sad scenario in my two decades of lawyering in this state.

Protect Yourself And Your Family!

So check your policy’s declarations page and see if you’ve been scammed by your own insurance agent or broker. And if you have elderly parents, please check their declarations page too.

The elderly gentleman I mentioned took this bad coverage news with a gracious smile. Maybe, in this day and age, seniors just expect to be taken advantage of.

That’s the saddest part of all this.